Youth Week Contest – Win a $100 gift card to Knoebels Resort!

Youth Week is one of our FAVORITE events of the year! We are celebrating Youth Week, April 22 – 26, 2024. Don’t miss our Youth Week Special Offer for our Youth Club Members ages 0 – 18. Make a deposit of $10 or more into your account during Youth Week and be entered to win a $100 gift card to Knoebels Resort.

You will receive an entry for every $10+ deposit made into your youth club account during Youth Week, with a maximum of one entry per account, per day. You can make your deposit online or through our branch offices. If you make an online deposit, you MUST send an email to staff@bluechipfcu.org including your name and your child’s name to receive an entry into the contest. We need to receive your email no later than April 26th at 9:00 p.m. to be included in the Youth Week drawing.

Not a member of Blue Chip FCU? Open an account for your child or teen, and they will automatically be enrolled into our Youth Clubs.

Contest Information: BCFCU is a member of NCUA. Member, parent, grandparent, or other person can make the deposit into the youth member’s account. One entry per youth member per day. Deposits can made online, at our branch or drive-thru, night drop box or mailed in to be eligible for drawing. Drawing will take place the first week of May, 2024. All deposits must be made by 9:00 p.m. on Friday, April 26th to be eligible for the prize. Winner will be notified and must come into the branch to pick-up their prize. To be entered into the drawing without making a deposit, please send in a 4 by 6 postcard with the member name, phone number and home address to the credit union: Attn: Marketing Department, Blue Chip FCU – 5050 Derry Street, Harrisburg, PA 17111. All entries must be received by Friday, April 26, 2024.

Youth Month – New Member Special

Open a new youth account (ages 0 – 18), and we will match* your initial deposit up to $25.00. Don’t delay! Offer expires April 30, 2024. You can open your account online or stop by any branch location!

*Match will be deposited at the end of May 2024. Account must remain open for a minimum of 30 days to receive $25.00 match.

Youth Month Coloring Contest

April is Credit Union Youth Savings Month! We will be celebrating all month long with a Kid’s Zoo Club Coloring contest! 3 participating members will be randomly chosen from each Blue Chip FCU Branch to win a $10 gift card.

To enter, print off the coloring sheet (or pick one up at any branch location) and return to the branch of your choice or mail to our main office located at 5050 Derry Street, Harrisburg PA 17111. Deadline for entry is April 30, 2024. Please include member name and phone number on back of color sheet. Coloring sheets will be displayed at each branch throughout the month of April. Winners will be selected the first week of May, 2024.

Happy Youth Savings Month!

Certificate Special – Watch Your Money Grow!

Certificates of Deposit: 12-Months = 5.24% APY*

For a limited time, take advantage of our 12-Month Certificate of Deposit at 5.24% APY*. Member Loyalty Rewards Points DO apply to this special rate! Stop by any branch or call 1-800-782-2328 to open your Certificate of Deposit.

* APY = Annual Percentage Yield. Per the National Credit Union Administration (NCUA), the standard share insurance amount is $250,000 per share owner, per insured credit union, for each account ownership category. Minimum deposit for Regular Certificates = $500. Minimum deposit for IRA Certificates = $1,000. Additional rate increases may be available on certificates through our Member Loyalty Program. Rates and yields subject to change without notice. Contact us for details.

Blue Chip FCU Annual Member Meeting

SAVE THE DATE!

When: April 27, 2024 – 9:00 a.m.

Where: Linglestown American Legion, 505 N. Mountain Road, Harrisburg, PA

Get complete details and reserve your spot today!

Blue Chip FCU $2,000 Scholarship Applications NOW Available

Every spring, 3 members will be chosen to receive a $2,000 scholarship (given in $1,000 increments over two years) to continue their education at a college, university or trade school. Our scholarship is open to all members looking to continue their education including non-traditional working adults. Applications are currently being accepted. Application deadline is May 31, 2024.

Apply Today! Scholarship Application 2024

$24 in 2024 Referral Special – Share the Love of Membership!

Share the love of credit union membership with your family and co-workers and receive $24 for every referral who joins Blue Chip FCU. Referred member will need to bring in a Member Referral Card. Stop by any Blue Chip FCU office, call us at 1-800-782-2328 to have cards mailed to you or download and print your own member referral cards $24 in 2024 Referral Card. Don’t delay! Share the love of credit union membership TODAY!

*Referred member will need to bring in a member referral card when opening account for current member to receive the bonus. $24 bonus will be deposited into referring members account within 30 days of account opening. Account must be opened in calendar year 2024 for referring member to receive a $24 bonus. Blue Chip FCU is a member of the NCUA.

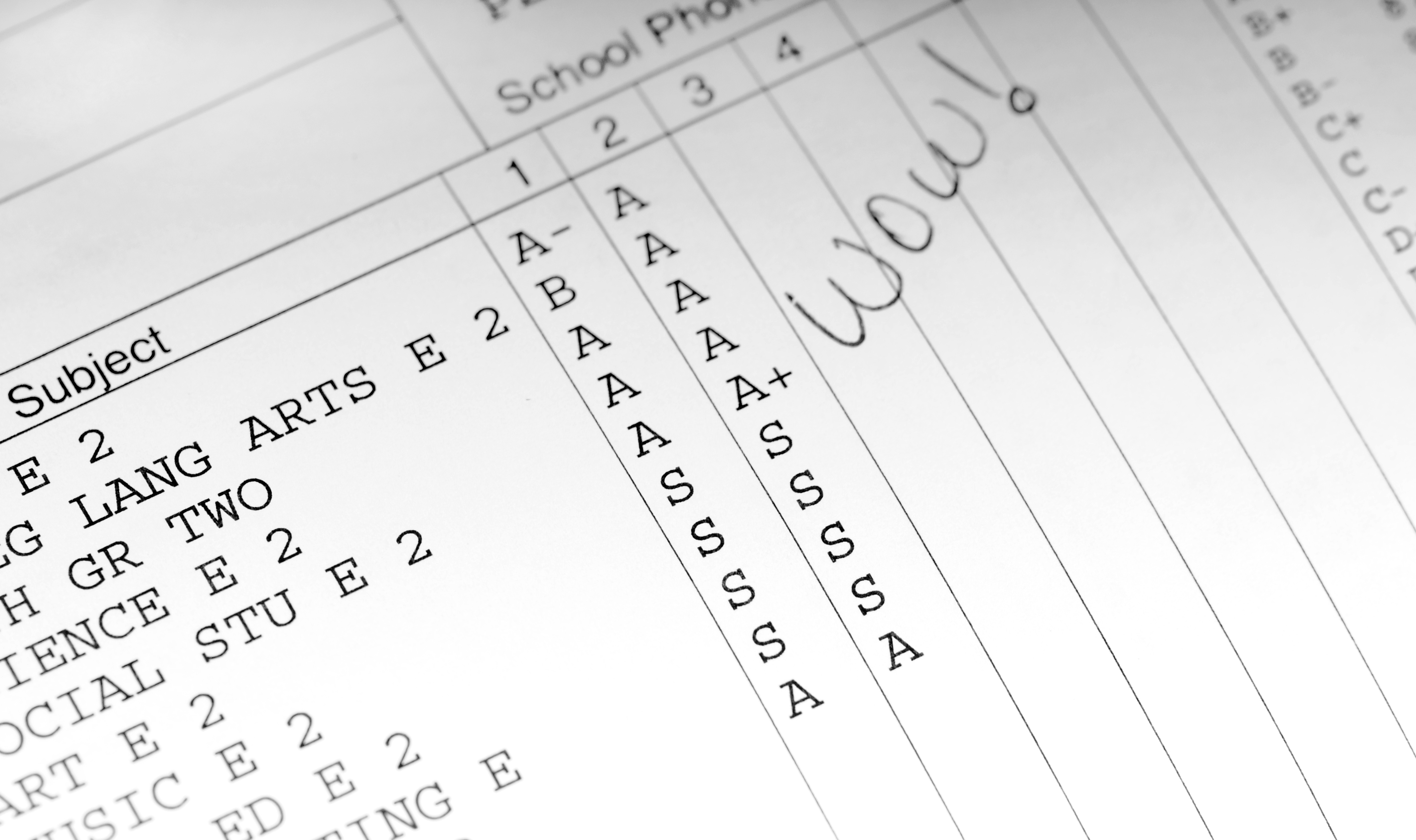

Teen Club Academic Rewards Program

We know you work hard everyday on your studies and your determination and persistence will pay off in the “real” world. BCFCU brings the real world payoff to you just a little earlier in life with our Academic Rewards Program.

The program is open to members in 7th – 12th grade.

Bring your report card to your closest BCFCU branch.

- For every report card with a cumulative average of a B and above, the member will receive a $10 VISA Gift Card.

- Members can earn up to 3 $10 VISA Gift Cards a year. Rewards can be redeemed through July 30th for the previous year. Ex: Members can bring in report cards for the 2023/2024 school year until July 30, 2024. Member must bring in a printed copy of the report card showing a grading scale.

Disclaimer: The credit union holds the right to discontinue this program at anytime without notice. High School Seniors turning 18 during the school year will still qualify for the rewards program through the end of their senior year.

2.99% APR Intro VISA Credit Card

Looking to make a BIG purchase? Take advantage of our 2.99% APR* Intro VISA Credit Card! Get 2.99% APR* on all purchases made in the first 12 months. The best part…. you keep 2.99% APR for the lifetime of those balances!

Rate will revert to as low as 8.99% APR at the end of the 12-month period. In addition to a great rate, also enjoy rewards points! Earn one point for every dollar spent. Points can be redeemed for merchandise, gift cards, travel and even charity donations.

* APR equals Annual Percentage Rate. Rate of 2.99% APR will apply to all purchases made in the first 12 months. Member will keep 2.99% APR on all purchases made in the first 12 months until they are paid in full. VISA credit card rate will revert to as low as 8.99% APR

(or what you were approved for at time of application) on purchases made AFTER the first 12 months. Equal Opportunity Lender. Rate subject to change without notice.

Love My Credit Union Rewards Program – Just for YOU!

Your credit union membership is about the trust and care of community, built around where you live, work and play. That’s why Blue Chip FCU membership saves you money through exclusive member-only offers through our trusted partners. Through Love My Credit Union Rewards, credit union members have saved over $2 billion with offers like:

» Savings up to $15 on TurboTax federal products.

» Exclusive discount from the TruStage Home & Auto Insurance Program.

» Members save on SimpliSafe, the #1 expert pick for home security.

» Save 30% on premium identity protection from Financial Lock.

» Exclusive access to the Love My Credit Union Rewards Powersports, RV & Boat Buying Program.

» Save on car maintenance + get $10 off your first service using CarAdvise.

» Save 40% on a 1-year membership to Sam’s Club.

» Build your credit history with rent and save up to 30% with Rental Kharma.

» Save $40 on Calm, the #1 app for meditation and sleep.

» Save on your Travel and Entertainment needs like Car Rentals, Hotels, Theme Parks, Movie Tickets and more!

Learn all about how your Blue Chip FCU membership gets you all these exclusive savings and more at LoveMyCreditUnion.org. Check them out and start enjoying credit union member benefits you never knew you had.